Financial Literacy

client advisor is here Betterment Inc., delivers financial literacy, in person (via Zoom), webinar training, hosted educational events and certified personal finance eLearning courses.

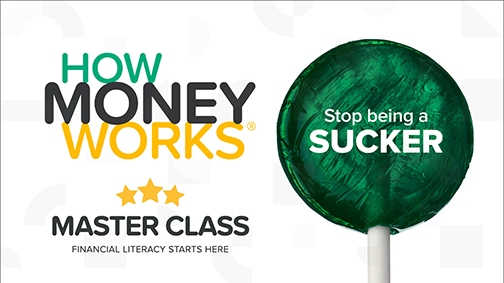

Curriculum is based on our textbook “How Money Works” and eLearning courses presented in English and Spanish.

We deliver financial literacy, through personal finance eLearning courses developed by our research team the Finance Literacy Institute, and based on our text book “How Money Works”. All courses can be translated into multiple languages, using the website translation tool, however the How Money Works Master Class is translated into in Spanish.

Financial Literacy - Can a Book About Money Change Lives?

Personal Finance eLearning Courses

Learn How Money Works

Cut through the noise, face today’s realities, learn foundational concepts, and simple, practical steps to follow.

Learn To Apply Your Knowledge

Gain skills like long-term vision, the ability to plan for the future, and the discipline to use those skills every day.

Learn To Get Your House In Order

Implement, execute and manage your strategy. Put your family on the path to a prosperous financial future.

The quizzes provide a pathway for students to see progress and the online format means that students work at their own pace. Courses Include our Debt Freedom eBook, a Debt Free Analysis, and a Debt To Wealth Report.

Financial Wellness Planning

Our financial wellness solutions start and end with certified financial instructors and independent Financial advisors.

Betterment Inc. Developed By Financial Literacy Group LLC, Is A Collaboration Of Solution Specialists client advisor , Software Developers, Systems Integrators, Debt Counselors, Certified Financial Educators, Experienced Independent Financial Advisors, Insurance Agents And Incentive Tax Recovery Experts, Who Are Dedicated To The Wellbeing Of You And Your Employees’.

Unlike Many Financial Wellness Companies and client advisor , We Don’t Offer Any Loan Restructuring Schemes, We Are Consumer Advocates. This Means No Loan Modification, No Refinancing, No Debt Consolidation, No Debt Settlement. Our Debt Solution Is Strategic Payoff And Proprietary Debt Reduction Techniques.

Our Algorithm Based Technology Pinpoints Exactly Where A Person Is Financially. The Go Debt Free SaaS Calculates A Mathematical Strategy That Substantially Shortens Debt Payoff Times And It Eliminates Interest On All Kinds Of Debt.

As A Result Our Hybrid Financial Wellness Solutions Educate, Inform, Engage, And Equip Each Employee With The Knowledge And Tools They Need To Take Control Of Their Financial Future.

Betterment Inc, connects program members, employers and employees with independent financial advisors, certified financial educators, certified financial planners, experienced financial investment advisors.

Our financial coaches are trained professional who collaborate with and guides the employees to reach their financial goals. The process is personalized and non-judgmental. Financial coaches provide support, encouragement, accountability, and tools to help people make informed decisions.

Financial coaches individualize their approach based on the unique needs of each person served, with the goal of helping them make progress in the area of their financial life that they identify as most important.

Financial coaching is a flexible approach that can work for many types of clients with a wide range of financial goals. People who receive financial coaching demonstrate:

- Increased goal attainment

- Better money management skills

- Improved savings, debt levels, and credit scores

- More financial confidence

Financial Literacy Content

Our library of financial content houses thousands of marketing and educational finance posts, articles, videos, blogs, podcasts, advice, presentations, webinars and media appearances.

New content is researched, produced and created every week specifically in adult market segments, including Generation Z, Generation X, Millennials, Baby Boomers. All courses can be translated into multiple languages, using the website translation tool, however the How Money Works Master Class Online is also offered in Spanish.

We client advisor further promote, measure and evaluate employee engagement and participation through online survey, and KPI driven analytics. Our team participates, tracks and promotes the financial accomplishments of our clients, your employees for years, if not their lifetimes.