Why Choose The Mega HSA Contribution Matching Account?

The Mega HSA (Contribution Matching Health Savings Account) is the ultimate medical benefit savings account available and will help our customers be able to both save money on their out-of-pocket, medical expenses and also increase their primary health insurance plan deductibles to save up to 40% or more on their monthly premiums over time.

This is because the solution awards its owners up to $2 in medical benefits or more for every $1 contributed into their Mega HSA account balance as the program progresses, which will allow our customers to raise their health insurance deductibles and lower their monthly premiums over time because their Mega HSA Medical Benefits Account is designed to cover their out-of-pocket, medical cost obligations up to the higher deductibles.

How It Works

The Mega Medical Reimbursement Visa® Prepaid Card will be swiped at the point-of-service to pay for nearly all our cardholders’ medical services including copays and deductibles up to their Mega HSA account balance at the time of the medical expense and can be used by either individuals or families. The Mega HSA Medical Benefits Account also comes included with unlimited telemedicine services. In addition, Mega HSA accounts also pay for elective procedures (with MD surgeons only) that are not covered by health insurance such as plastic surgery, Lasik and fertility among many others.

Why You Need Mega To Maximize Your Health Insurance

There are numerous and sometimes very hard to understand additional, out-of-pocket, costs associated with your health insurance that you will be forced to pay aside from your monthly premiums. These include not only paying for your deductibles but also coinsurance, copays and annual, out-of-pocket maximums associated with your plan.

The Mega HSA (Contribution Matching Health Savings Account) is the best, medical savings account option for you to turn to in order to lower all of these out-of-pocket obligations because of its significant, account crediting guarantees and features that will credit your account up to $2 or more for every $1 that you contribute into your account.

Gap Closing Benefits

1) The Mega HSA Has Better Benefits. You Name It. We Cover It.

- Unlike its Gap Insurance and Medicare Supplemental competitors, the Mega HSA can be used for ANY medical expense

- This includes elective procedures (with MD surgeons only) like fertility procedures, Lasik and plastic surgery

- Monthly rates do not increase and the growth rate of your Mega HSA account is guaranteed

2) The Mega HSA Is A Better Value

- Find The Mega Plan That Fits Your Budget: You choose the amount you want to contribute each month into the plan from one of our 11 different monthly contribution options that can fit into any family’s monthly finances

- Your account will grow on average $2 for every $1 that you contribute into your account to pay for all of your out-of-pocket, medical expenses including copays, coinsurance, deductibles, doctor visits, pharmacy costs and any other medical expense that you can think of

- Empower Yourself Not The Insurance Companies: WHY LEASE YOUR MEDICAL BENEFITS WHEN YOU CAN OWN THEM INSTEAD? As opposed to throwing your money away on monthly insurance premiums and benefits that you may or may not ever use, your unused Mega HSA medical benefits that you receive each month will carry over each year as your account builds until YOU decide how you wish to use them

3) Avoid The Headaches: The Mega HSA Is Easier To Use Than Any Other Alternative

- Steer clear of the hassle of the medical expense filing process that can take months to settle

- Take matters into your own hands with your own Mega HSA Medical Reimbursement Visa® Prepaid Card and resolve your payment immediately on the spot by swiping your Mega HSA card at your service provider

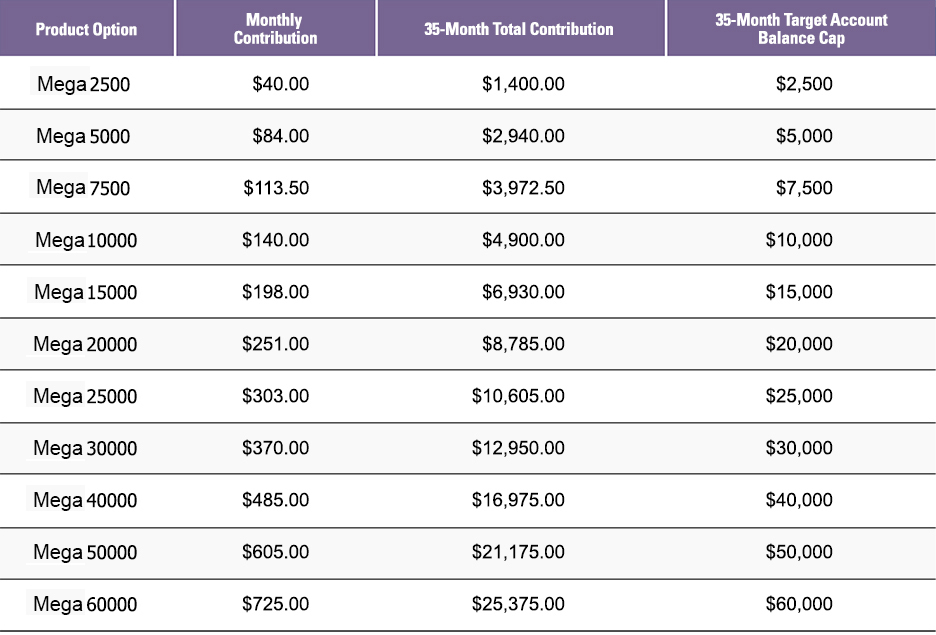

Mega HSA Monthly Contribution Options

- Total contribution amounts assume no prior medical expenses paid for with your Mega Medical Reimbursement Visa Prepaid Card

- Monthly contribution amounts vary based on the contribution and number of family members on the plan.

- The Mega 2500 and the Mega 5000 have no additional charges, but starting at the Mega 7500 level additional charges applied are $5 per month for the first dependent and $10 additional per month for the second or more dependents

- Your monthly payment amount and its corresponding account balance cap be changed on monthly basis.

Further Contribution Options

- Individuals and Families can select from a variety of different account balance level maximums ranging from $2,500-$60,000

- Product options can fit any individual or family budget with the ability to scale up or scale down the monthly contribution amount and the corresponding target account balance cap as needed

- No further monthly, participant contribution once balance reaches target account balance cap (only maintenance fees are required)